Loan depreciation schedule

Go to Screen 22 Depreciation. If the assets depreciable value is 10000 the first years depreciation is 3333 515 x 10000.

Loan Amortization Schedule Deals 57 Off Www Wtashows Com

This limit is reduced by the amount by which the cost of.

. Update Gray Fill -. Professional Template for Depreciation Amortization Calculations. Best Personal Loans 2022.

It also determines out how much of your repayments will go towards. Calculation of Fixed Assets depreciation using the 3 main depreciation Methods Inputs. Follow these steps to enter amortization of mortgage points on the Schedule A.

Your entire house has 1800 square feet of floor space. Calculation of Fixed Assets depreciation using the 3 main depreciation Methods Inputs. Section 179 deduction dollar limits.

This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. Ad Review a Free List of the Best Tax Depreciation Scheduling Products - Start Today. The first is the systematic repayment of a loan over time.

Scroll down to the Federal. Ad Low Interest 2022 Top Lenders Comparison Reviews Top Brands Free Online Offer. Best Personal Loan Companies.

This is a schedule showing the repayment period of the loan you have taken. Lets assume that you are offered the. Ad Review a Free List of the Best Tax Depreciation Scheduling Products - Start Today.

Update Gray Fill -. Make the election under section 179 to expense certain property. The room is 12 15 feet or 180 square feet.

Compare Offers Apply Instantly. Applying Wont Hurt Credit. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

Select the desired Depreciation Method from the Drop-Down List. Ad Fixed Rates from 349 APR. In our example lets use our existing cost basis of 206000.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. Claim your deduction for depreciation and amortization. Fill in the estimated years the asset will remain in service.

For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000. 41 rows This amount would be the interest youd pay for the month. As a quick example if.

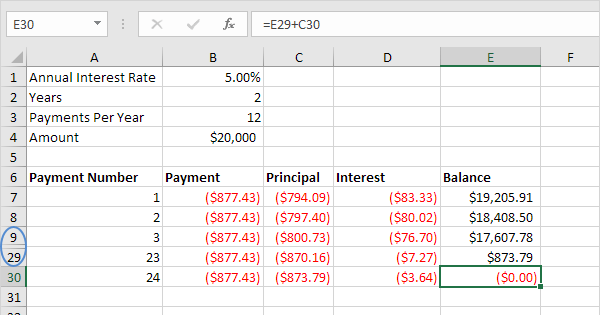

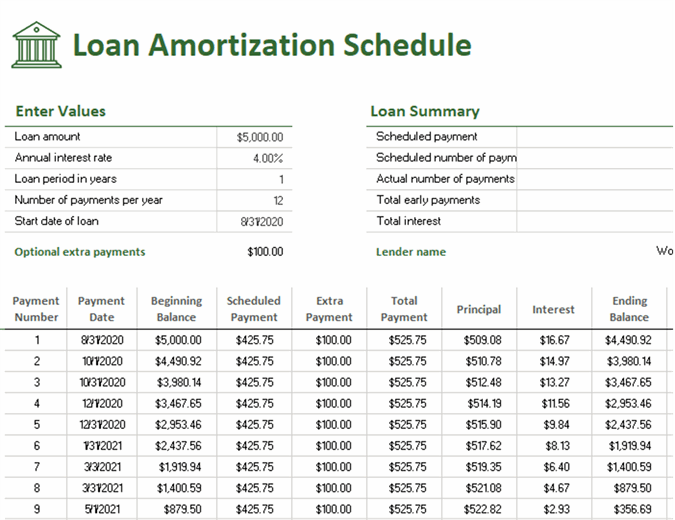

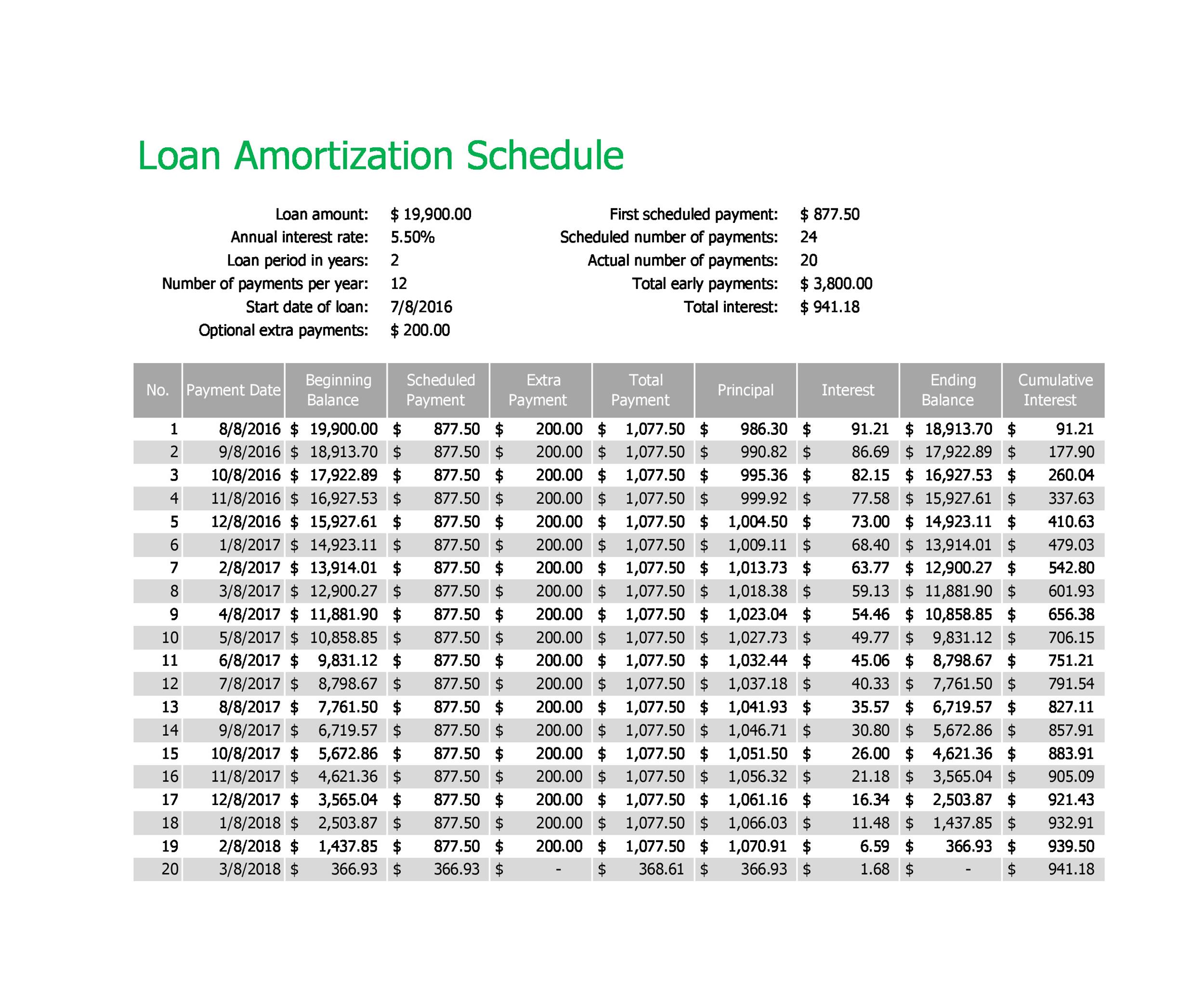

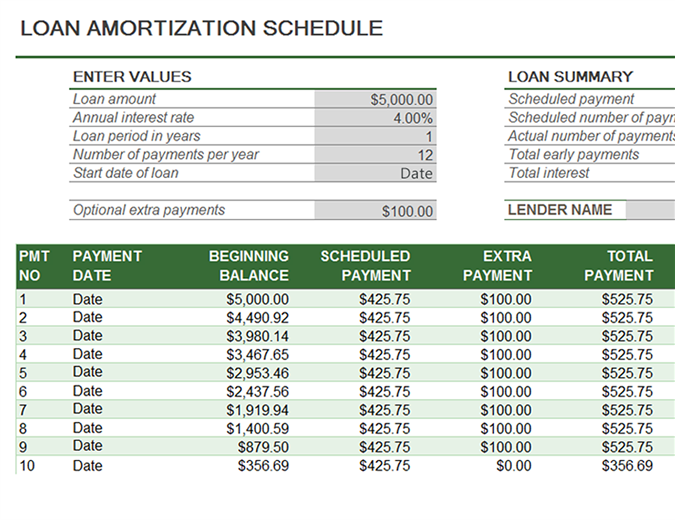

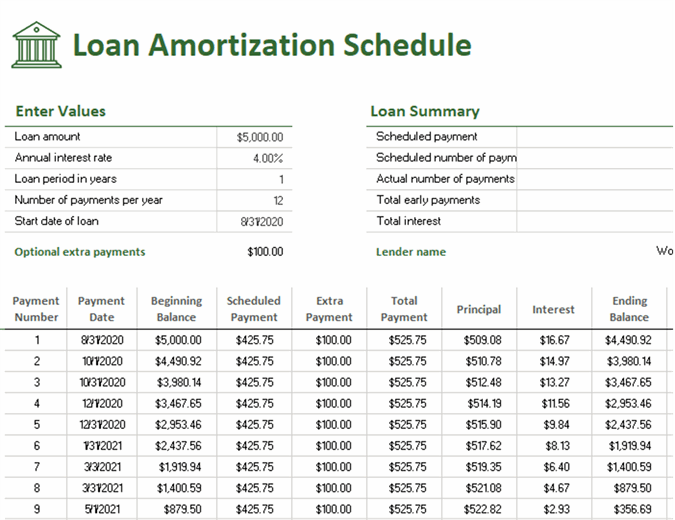

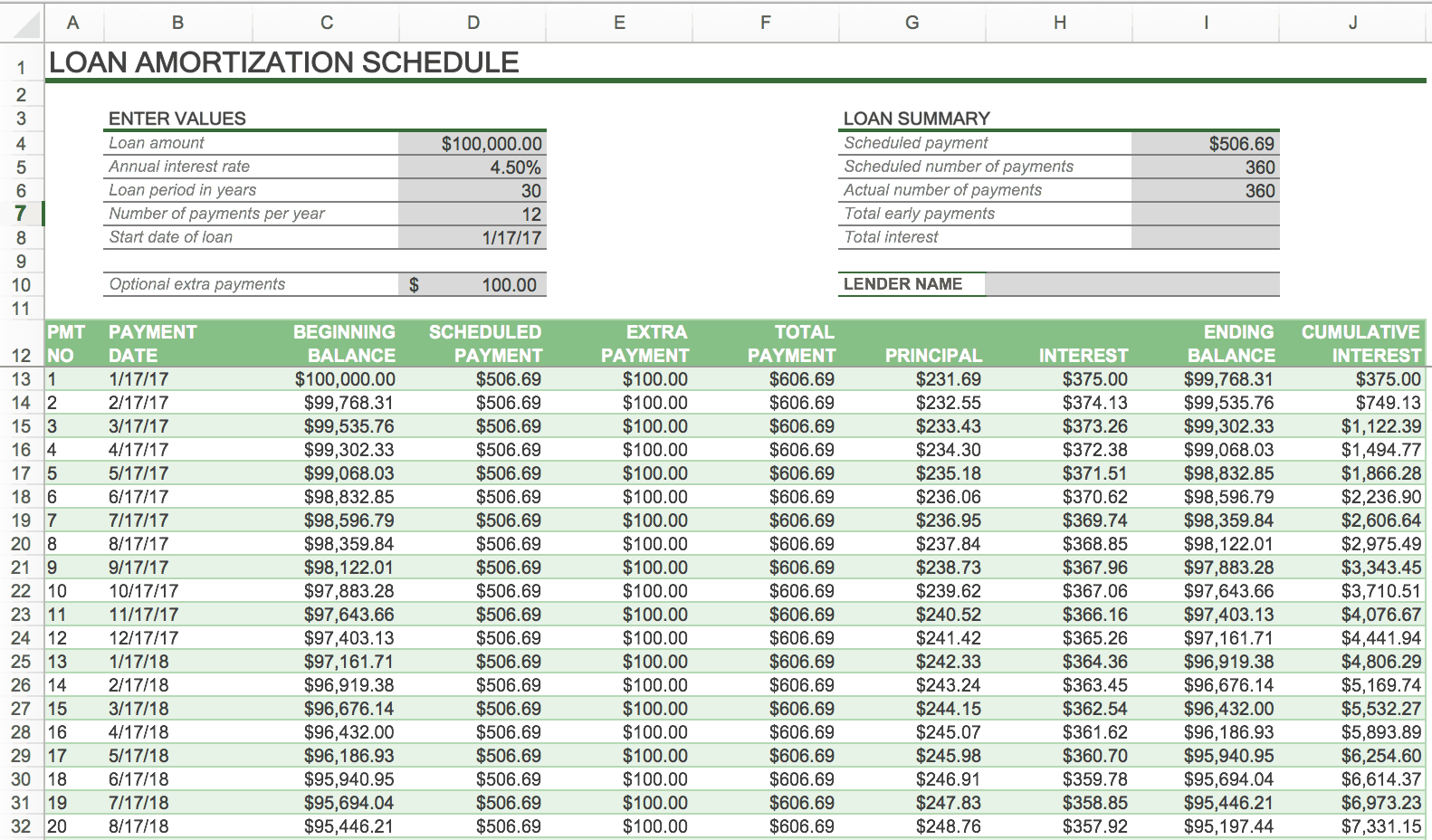

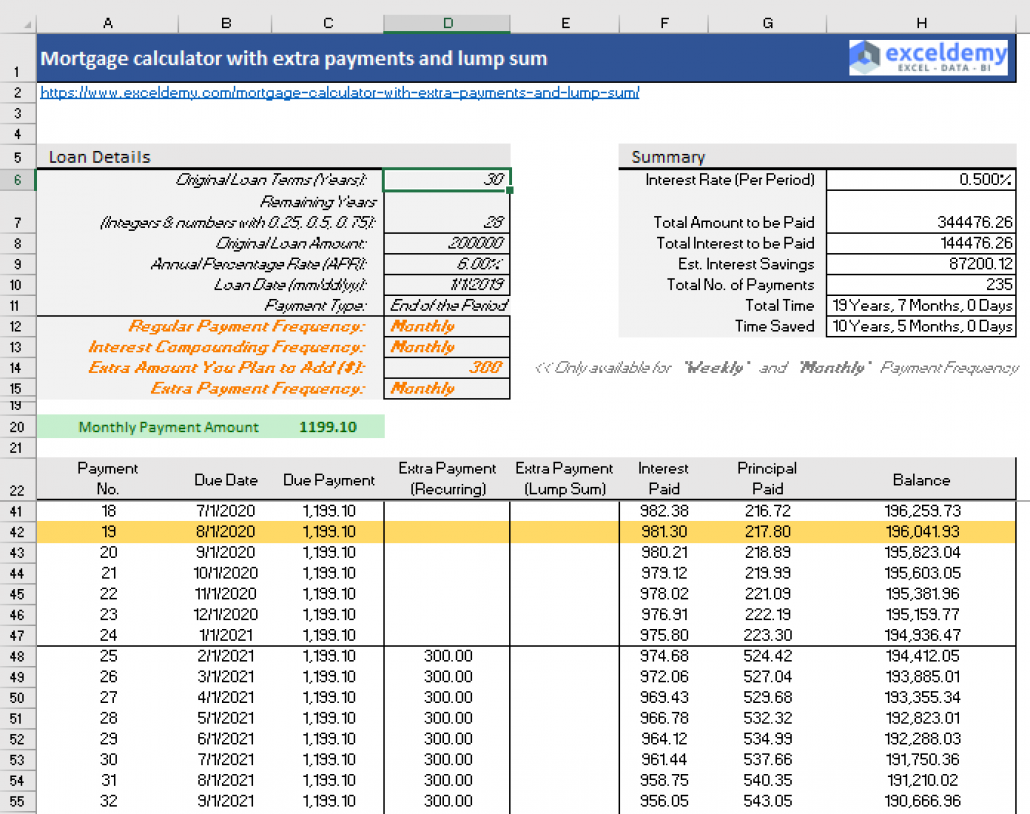

The Loan Amortization Schedule is a table that shows how the borrower will pay back the amount of the loan over the period of time stipulated. Use Form 4562 to. It also calculates the monthly payment.

You can deduct as a rental expense 10 of any expense that must be divided between. Professional Template for Depreciation Amortization Calculations. Provide information on the.

It is basically a table that determines the principal amount and amount of interest compromising each. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Select Schedule A from the left panel.

There are two general definitions of amortization. Most of the formula stays the same in subsequent years. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan.

The second is used in the context of business accounting and.

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

:max_bytes(150000):strip_icc()/dotdash_Final_Amortized_Loan_Oct_2020-01-3a606fa9285943098248ac92e8d03b40.jpg)

What Is Amortization Schedule

Loan Calculator With Amortization Schedule Clearance 56 Off Www Ingeniovirtual Com

Printable Amortization Schedule Templates Amortization Schedule Schedule Templates Schedule Template

Loan Amortization Schedule Deals 57 Off Www Wtashows Com

Loan Amortization Schedule Free For Excel

Loan Amortization Schedule Cheap Sale 53 Off Www Wtashows Com

Loan Amortization Calculator Sale 60 Off Www Wtashows Com

Mortgage Amortization Schedule Online 60 Off Www Wtashows Com

Loan Amortization Schedule Deals 57 Off Www Wtashows Com

28 Tables To Calculate Loan Amortization Schedule Excel ᐅ Templatelab

Amortization Vs Depreciation What S The Difference My Tax Hack

Amortization Schedule Calculator

Loan Amortization Schedule Deals 57 Off Www Wtashows Com

Easy To Use Amortization Schedule Excel Template Monday Com Blog

How To Prepare Amortization Schedule In Excel With Pictures

Amortization Chart Template Create A Simple Amortization Chart